Build & Test Your Winning Algos

Develop & Deploy Your Algos

Unleash your quantitative skills with Vega Simulator's Algo Trading Simulator. Develop, test, and refine your own Python-based trading algorithms in a realistic market environment, designed specifically for users with Python and capital markets experience.

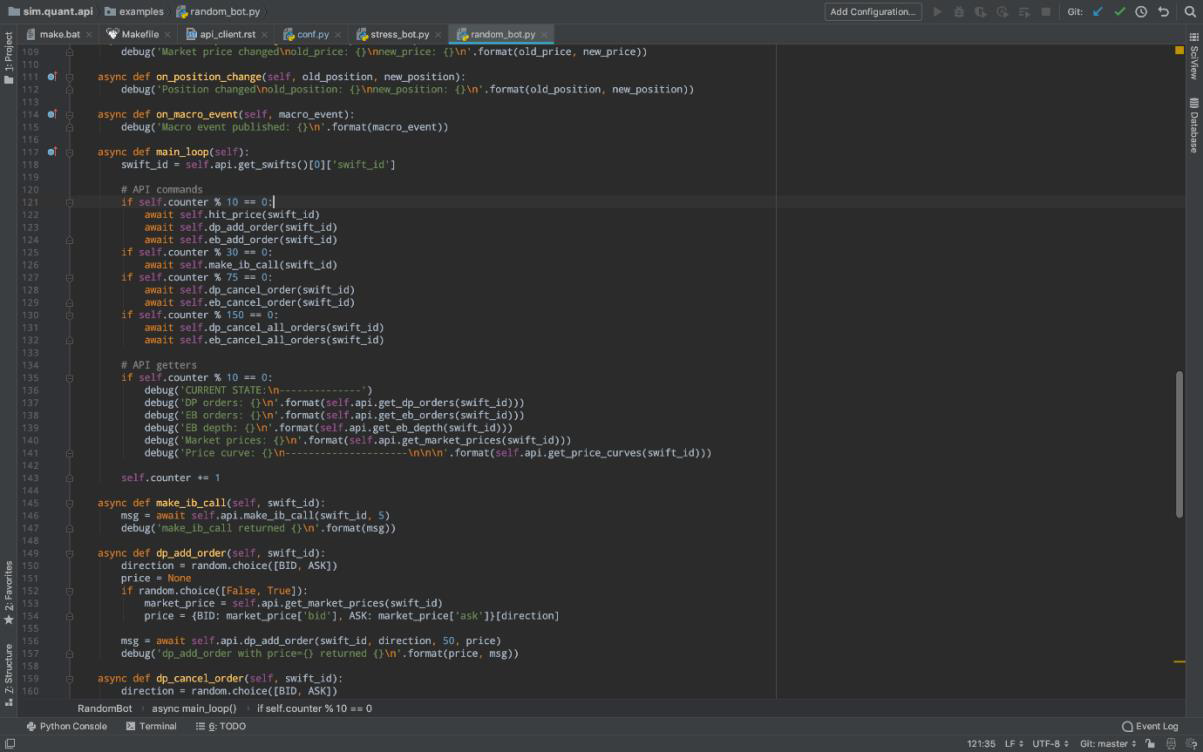

- Python-Powered Development.

- Start with our provided examples and use Python to code your own unique trading algorithms.

- Local Control via API.

- Install the Vega Simulator API on your local machine, giving you full control to modify existing algos or build new ones from scratch.

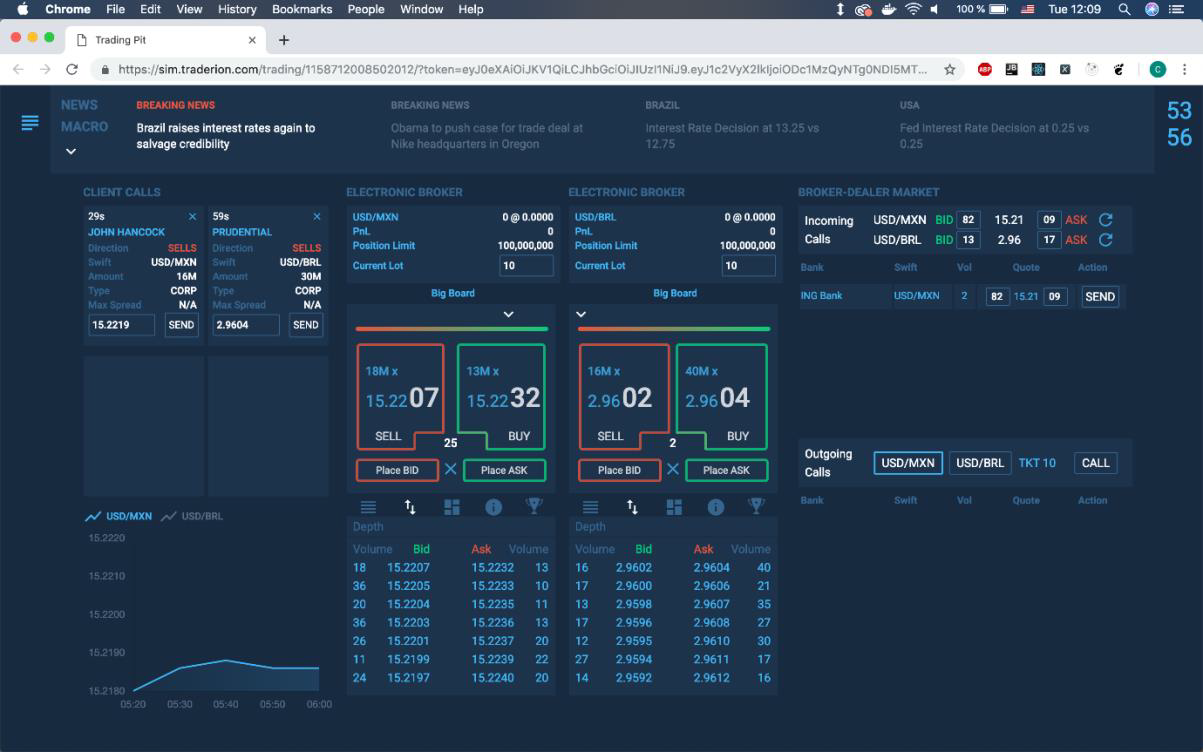

- Live Testing Arena.

- Once ready, enter a trading session and pit your algorithm against others to evaluate its real-world effectiveness.

- Prerequisites.

- Best suited for participants comfortable with Python programming and possessing foundational knowledge of capital markets.

Master Algorithmic Trading Skills

Key Learning Outcomes.

This section focuses on translating your coding and market knowledge into effective, automated trading strategies through hands-on development and testing.

- Market Dynamics Analysis

- Learn to interpret current market states and anticipate future conditions to build more adaptive algorithms.

- Algo Logic Enhancement.

- Gain practical experience in modifying, debugging, and improving the core logic of trading algorithms.

- Real-World Algo Behavior.

- Observe firsthand how different trading algorithms interact and perform within dynamic, simulated market scenarios.

- Practical Python Application.

- Directly apply and strengthen your Python programming skills in the specialized domain of capital markets.

- Profit-Driven Design.

- Focus on developing and tuning algorithms with the specific goal of achieving profitable trading outcomes.

- Understand Underlying Strategies.

- Recognize market patterns and behaviors driven by various participant strategies (reflecting implicit client needs).

- Integrate Analysis.

- Implement methods for your algorithm to utilize both technical indicators and fundamental data in its decision-making.

- Automated Strategy Execution.

- Learn to codify and automatically implement basic trading strategies within your algorithms.

Benchmark & Improve Your Algos

Evaluation and Feedback.

Receive a detailed post-session performance report, mirroring the feedback professional algo traders receive. Gain valuable context by benchmarking your algorithm's performance.

- Peer Algorithms.

- See how your creation compares to strategies developed by other simulator participants.

- In-House Benchmarks.

- Measure your results against sophisticated algorithms developed by Vega Simulator.

- Iterative Refinement Loop.

- Use the comprehensive feedback to identify areas for improvement, refine your code, and re-test your enhanced algorithm in subsequent simulations.