Master the Markets

Experience Real-World Trading

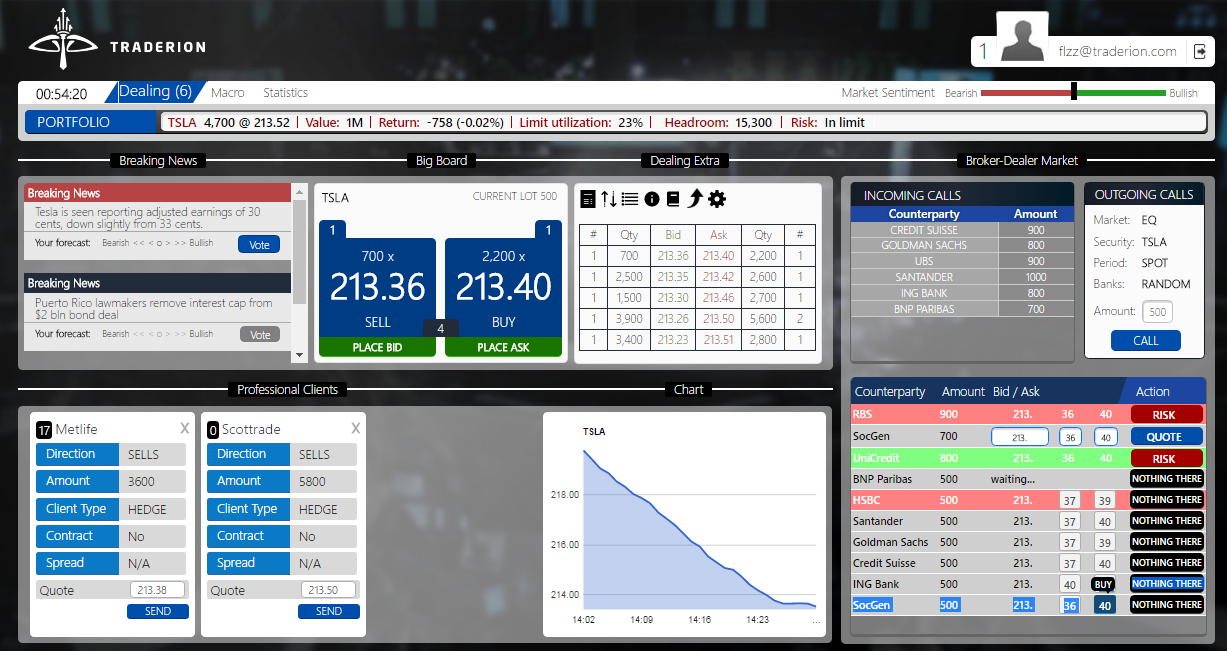

Vega Simulator's Market Trader simulation offers an immersive experience where participants can realistically engage in market trading and sharpen their skills through gamification

- Unmatched Variety.

- Dive into 500+ scenarios across FX, Equities, Commodities, Bonds, and Rates.

- Adaptive Challenge.

- Progress through 3 difficulty levels tailored to your experience.

- Dynamic Interactions.

- Trade alongside live and algorithmic participants whose strategies evolve.

- Authentic Client Engagement.

- Interact with simulated corporations and hedge funds, just like in a real trading environment.

Develop Critical Trading Competencies

Key Learning Outcomes.

This section focuses on honing the core, practical skills every market trader needs, from analyzing markets and executing trades to managing risk and understanding client interactions.

- Market Analysis.

- Grasp current/forecasted market states and link them to economic events.

- Technical Skills.

- Recognize basic chart patterns and trading concepts.

- Client Acumen.

- Understand diverse client strategies and needs.

- Risk Management.

- Confidently manage long and short positions.

- Strategy Implementation.

- Apply fundamental trading strategies effectively.

- Execution Excellence.

- Enhance speed and accuracy in client transactions.

Track Your Progress & Refine Your Skills

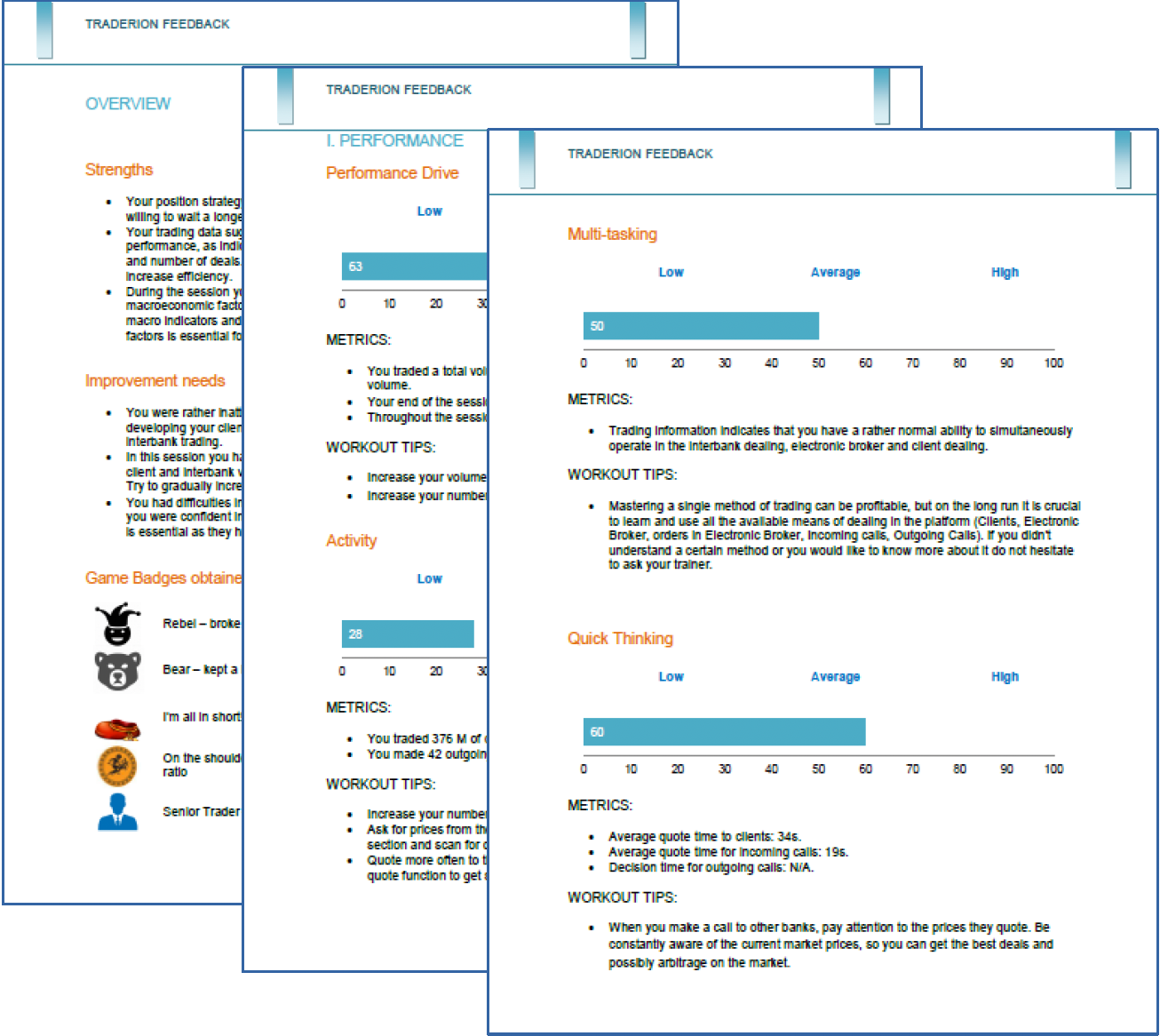

Evaluation and Feedback.

Receive a detailed post-session performance report. Understand your strengths and weaknesses across:

- Performance.

- Analyze your profitability (P&L), win rates, and overall trading results.

- Trading Profile.

- Understand your trading style, such as frequency, preferred instruments, and order types used.

- Positioning.

- Evaluate how effectively you manage your market exposure and inventory over time.

- Risk Profile.

- Assess how well you manage risk through measures like stop-losses, position sizing, and overall exposure control.