Master Options Trading

Web-based simulator

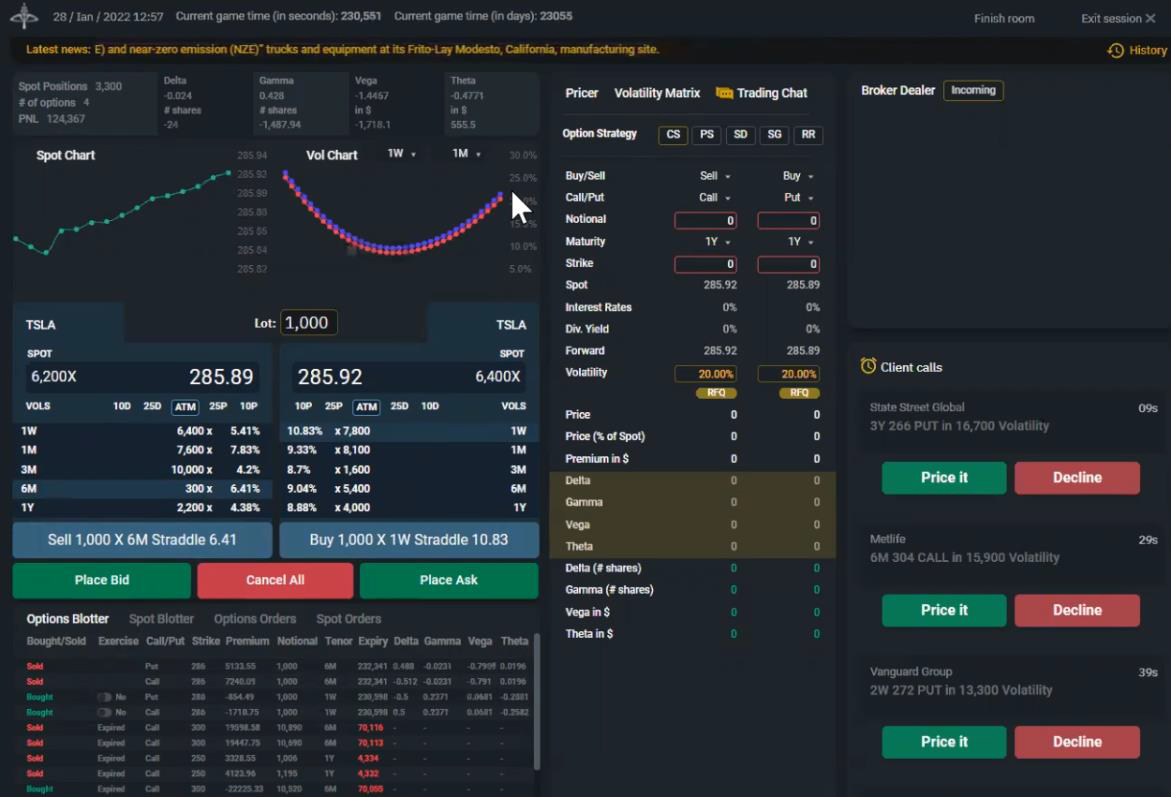

Dive into the intricate world of options trading with Vega Simulator's web-based simulator. Gain practical, hands-on experience with fundamental and complex options strategies using realistic, historical market data, available 24/7 for your learning convenience.

- Comprehensive Strategies.

- Trade a wide range of basic options and multi-leg structures, including Calls, Puts, Strangles, Straddles, Butterflies, Risk Reversals, Call Spreads, and Put Spreads.

- Real-Data Scenarios.

- Practice using historical scenarios built on actual market data, covering over 50 instruments across various global trading venues.

- Always Accessible.

- Hone your skills anytime, anywhere with 24/7 online availability.

- Customizable Competitions.

- Design private, tailored competitions for specific groups, setting unique rules like commission rates, trading timeframes, and initial cash balances.

Develop Advanced Options Expertise

Key Learning Outcomes.

This section focuses on building a deep, practical understanding of options mechanics—from core concepts and strategies to sophisticated risk management and market analysis in dynamic conditions.

- Options Fundamentals.

- Master the basics, including understanding option payoffs, implementing core strategies (like covered calls or protective puts), and grasping fundamental pricing concepts.

- Trading Process Insight.

- Gain clarity on how the options trading process works from both a trader's execution perspective and an investor's strategic viewpoint.

- Data Interpretation & Impact Assessment.

- Learn to effectively interpret financial data and macroeconomic news, evaluating their likely impact on both the underlying asset's price (spot market) and its implied volatility (volatility surface).

- Risk Management Mastery.

- Develop a strong understanding of options risk management techniques, the role of the Greeks (Delta, Gamma, Vega, Theta), and how to analyze Profit and Loss (PnL) attribution.

- Market State Awareness.

- Enhance your ability to read current market conditions, anticipate future states, and recognize evolving patterns in market behavior.

- Strategic Differentiation.

- Learn to clearly distinguish the purpose and application of different strategy types, such as hedging risk, making directional bets, or trading volatility itself.

- Volatility Impact Analysis.

- Understand precisely how changing volatility levels (both high and low) can significantly affect the performance and risk profile of your options strategies.

- Long-Term Strategic View.

- Develop the skill to connect a long-term view of market evolution with the selection and adaptation of appropriate trading strategies over time.

- Complex Strategy Execution.

- Build the capability to confidently structure, execute, and manage more complex, multi-leg options strategies within an international market context.

Evaluate Your Options Performance

Evaluation and Feedback.

Receive detailed feedback following each session, which includes both a comprehensive performance report and personalized insights from the instructor (provided for team and individual performance)

- Performance.

- Assesses the overall outcome of your portfolio – whether your strategies resulted in a net profit or loss.

- Trading.

- Evaluates your understanding and application of basic options trading principles and various options strategies.

- Risk Management.

- Gauges your comprehension of the options Greeks and your ability to manage the inherent relationship between risk and potential return.

- Positioning.

- Measures how effectively you anticipated changes in spot markets and volatility surfaces based on incoming information and positioned your portfolio accordingly.