Experience the M&A Deal Lifecycle

Lead Complex Deals.

Step into the high-stakes world of Mergers & Acquisitions with Vega Simulator's interactive simulator. Work collaboratively in teams to manage complex international transactions, advising either buyers or sellers to analyze data, devise strategies, and ultimately maximize client value.

- Team-Based Scenarios.

- Collaborate effectively with peers to navigate the challenges and decisions inherent in M&A processes.

- International Focus

- Engage with realistic scenarios involving cross-border transactions, requiring consideration of different market practices and regulations.

- Dual Advisory Roles.

- Gain perspective by taking on the role of advising either the acquiring party (strategic, financial buyers) or the selling party in various transactions.

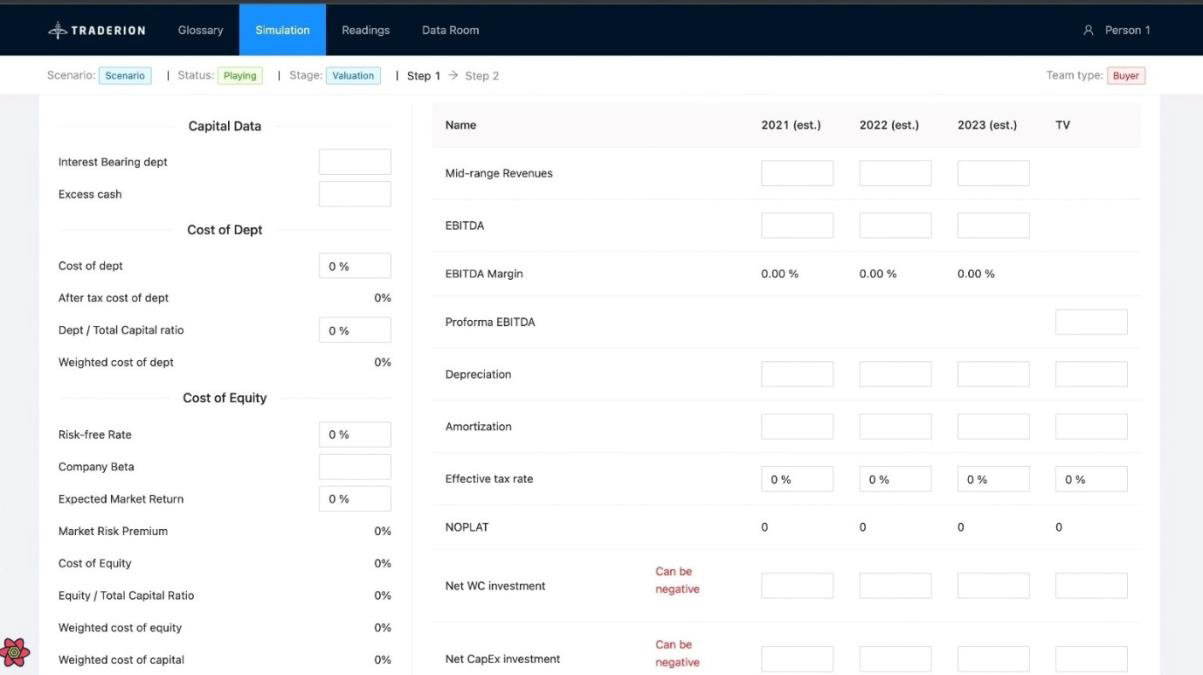

- Data-Driven Decision Making.

- Practice analyzing financial and market data to develop the best course of action and strategic advice for your client.

- Value-Focused Scoring.

- Your performance is measured directly by your ability to add value – gain points for sound advice, lose points for decisions detrimental to your client.

Develop Core Investment Banking Skills

Key Learning Outcomes.

This section focuses on providing practical experience in managing the M&A process from an investment bank's viewpoint, enhancing analytical, strategic, and client advisory capabilities.

- M&A Process Mastery.

- Gain a thorough understanding of the end-to-end M&A workflow, key stages (e.g., origination, due diligence, closing), and critical considerations from the perspective of an investment banker.

- Financial & Macro Analysis.

- Sharpen your ability to interpret complex company financial statements and relevant macroeconomic news to inform deal strategy and valuation.

- Volatility Impact Assessmen.

- Learn to recognize how market volatility can affect transaction timing, valuation multiples, financing availability, and overall deal feasibility.

- Market & Stock Price Dynamics.

- Develop skills in understanding current market conditions, anticipating future states, analyzing specific company stock price movements, and identifying patterns relevant to M&A activity.

- Client Advisory in Complexity.

- Practice formulating and delivering sound, value-adding investment advice to clients navigating the intricacies of complex, cross-border M&A deals.

- Navigating Regulation.

- Build confidence and understanding in operating effectively within the highly regulated legal and financial environments characteristic of M&A transactions.

- Complex Deal Structuring & Execution.

- Gain proficiency in the strategic aspects of structuring intricate M&A deals and understanding the key steps required for successful execution in an international context.

Evaluate Your M&A Acumen

Evaluation and Feedback.

Receive detailed feedback following each session, incorporating both a comprehensive performance report and personalized insights from the instructor (feedback provided for both team and individual performance).

- Transaction Outcome.

- Assesses the overall success of the simulated transaction based on the positive or negative financial impact resulting from your team's strategic decisions.

- M&A Concepts.

- Evaluates your grasp of core M&A terminology, fundamental processes (like auctions vs. negotiated deals), and how various concepts interrelate.

- Financial Statement Analysis.

- Measures your proficiency in reading, interpreting, and drawing meaningful conclusions from balance sheets, income statements, and cash flow statements.

- Risk & Synergy Assessment.

- Gauges your ability to identify potential transaction risks (e.g., market, execution, integration) and realistically assess the potential value creation from synergies.

- Client & Valuation Accuracy.

- Assesses your understanding of the motivations and needs of different client types (e.g., strategic vs. financial buyers) and evaluates the accuracy of your company valuation methodologies.